2023 was a banner year for Practice Real Estate Group and our clients. What can healthcare entrepreneurs expect in the Texas real estate market for 2024? We asked our market leaders to share their insights and strategic advice.

The Current Healthcare Real Estate Landscape

Retail Space (Most Common for Healthcare Practices)

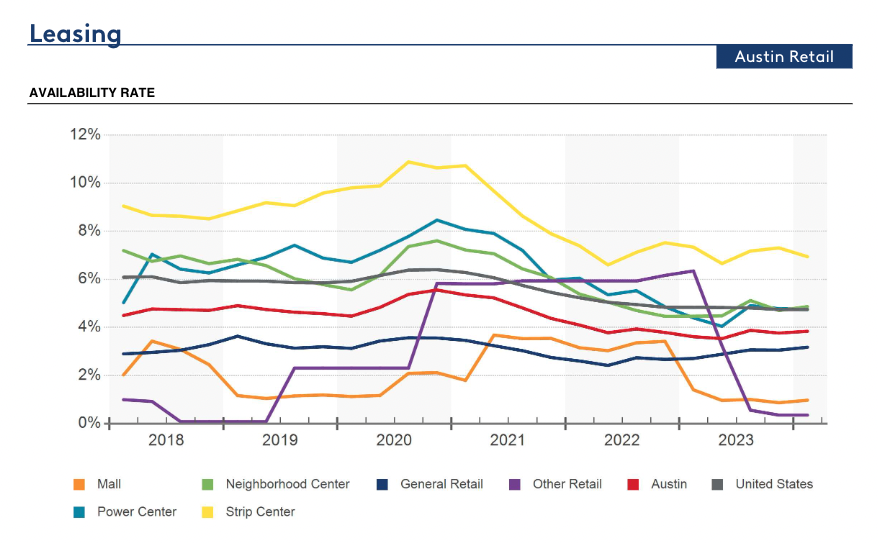

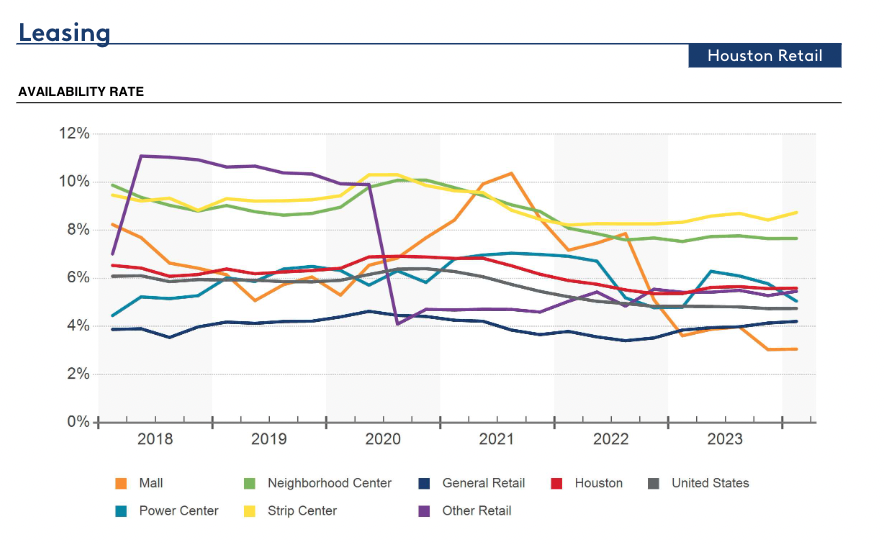

Market Reality: Retail space in Texas is 96-98% occupied across major markets. This high occupancy creates significant challenges for practice owners seeking ideal locations.

If you plan to open a practice within the next year, you need to:

- Start your search immediately

- Exercise patience and flexibility

- Avoid settling for suboptimal locations that could harm long-term success

Most available spaces in high-growth markets are either proposed or under construction. While this can make visualization difficult, these projects often lease quickly once they hit the market. If you see a new development (even just a sign and architectural rendering) in your target area, have your agent evaluate it – these can provide opportunities that slower-moving competitors might miss.

Medical Office Buildings (MOBs)

For specialists requiring traditional medical space (OB/GYNs, Cardiologists, etc.), MOBs near hospitals remain the standard. This market segment still has vacancies, but with 85% occupancy rates, the window of opportunity won't remain open indefinitely.

Building Purchases

The market for medical building purchases currently faces limited supply. The honest assessment: now may not be the optimal time to purchase your practice real estate.

However, we expect market changes within the next 8-14 months. Either:

- Interest rates will decrease, or

- We'll experience the market correction many have anticipated since COVID

Interest Rate Reality Check

Current interest rates for healthcare professionals are comparable to rates from 10-15 years ago. The ultra-low rates (2-3%) during COVID were anomalies resulting from exceptional circumstances.

If concerns about 7-8% interest rates are holding you back, consider this practical perspective: a 1-2 percentage point difference typically translates to a few hundred dollars in monthly payments, not thousands. If this relatively small amount is your primary hesitation, it might indicate timing issues beyond just the rate. Remember, refinancing remains an option when rates improve.

Strategic Recommendations for 2024

For Practice Owners Considering Real Estate Purchase

- Prioritize cash reserves. Build your down payment aggressively.

- Identify target locations now. Research growth areas aligned with your practice needs.

- Engage a healthcare-specific real estate agent. Available properties often attract multiple investors – you need someone actively scouting opportunities.

For Practices Planning Expansion

Avoid selecting secondary locations based solely on availability or urgency. A six-month wait for the right location delivers better long-term results than immediate occupancy in a compromised space. If your timeline is urgent, work with both your banker and real estate agent immediately to maximize options.

Regional Market Insights

Central Texas (Austin and Surrounding Areas)

"Despite high occupancy rates, opportunities exist throughout Texas for those willing to be strategic and patient. With over 100 people moving to Austin and surrounding communities daily, development will continue expanding throughout Central Texas for the next 5-10 years. While your exact desired location might not be immediately available, engage an agent to scout for you. Be prepared to wait six months for opportunities to emerge, and potentially another year for project completion. The patience yields optimal results." -Mark Storey

Dallas Market

"Dallas faces a 96% retail occupancy rate, leaving only 4% vacancy. This creates real challenges in finding optimal practice space. Most available spaces in desirable, high-growth areas are either proposed or under construction, requiring patience as tenants wait for delivery. This dynamic has remained consistent for several years. While patience is essential in the current market, continued growth drives new development, which will create additional opportunities over time."

Key Takeaways for Healthcare Practice Owners

The Texas medical real estate market presents genuine challenges due to high interest rates and low vacancy. Premium locations with critical practice success factors (ease of access, strong demographics, low competition, good signage, visibility, and branding opportunities) remain difficult to secure.

However, this market environment creates strategic opportunities for prepared practice owners:

- Start building cash reserves now to position yourself for quick financing when conditions improve

- Maintain flexibility and patience regarding location and timing

- Establish a relationship with a healthcare-specific real estate agent who can actively scout opportunities and educate you about the market before decision points arrive

While substantial opportunities remain in Texas' major metropolitan areas, our practical advice for 2024 is straightforward: prepare financially, partner with experts, and position yourself to act decisively when the right opportunity emerges.