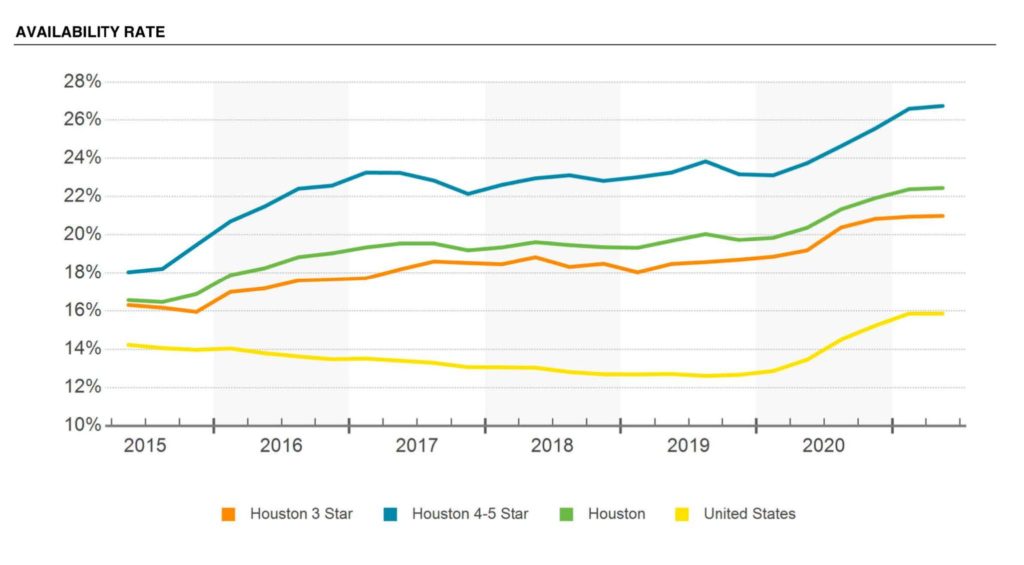

Office Demand Is Low – Here Are The Numbers:

A line graph from Co-Star displays the availability rates climbing in office buildings. Leasing volumes were down more than a third in 2020 compared with 2019, as tenants delayed leasing decisions during the pandemic.

Low Demand In Office Is Good For Tenants

With employees still working from home this quarter, traditional office buildings have copious amounts of vacant space. While the city is slowly turning back on, small offices and huge energy companies alike are now zooming instead of commuting and/or are downsizing as their spaces come up from renewal.

Medical office tenants, though, are stable businesses, provide essential services, and are in an excellent position to renegotiate their leases.

Peter Hays, a Houston agent, explains in greater depth: “Physicians and dentists are in an excellent position to renegotiate leases nearing expiration, space used for needed expansion, or de novo locations. Landlords have less leverage than they have enjoyed in the past with the vacancy left from traditional office space users. They are still quoting rates from 2020, but leases are being executed below those rates. You willstill see increases in materials used for construction due to various reasons, but overall, landlords and landlord brokers are easier to work with.”

Takeaway: While low office demand maybe tough on the city’s overall economy, physicians and dentists stand to capitalize on the opportunity.

How To Navigate Growth

Houston retail development has slowed down over the past year, and in 2020, construction starts fell to their lowest point on record. However, the city is starting to move forward, and there is around 2.2 million SF of retail space under construction, which – for context – places Houston among the top metros in the country for construction underway in retail space.

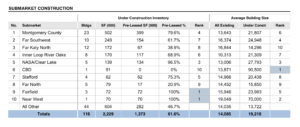

Construction Availability Chart via CoStar

George Allen, agent in the Houston market offers his take: “Projects that are under construction are still being able to pre-lease a large portion of the project prior to delivering it. While retail did take a hit, as the market gets going again, there is a lot of competition for space – not just with other medical/dental tenants – but with other small businesses and retail chains, too.”

A new theme is emerging as construction ramps back up: residents are starting to see retail space multi family housing, like apartments. This can include offices, wrapping up an entire lifestyle – work / live /play in one development.

Takeaway: Retail locations don’t necessarily mean a deal – expect some competition in new developments.

If You’re Looking To Expand, Consider This:

With Covid transmission slowing down, physician groups and stand alone practices are jumping back in the search for office space.

Banks are back in business, too. Lenders that came to a complete halt last year are accepting applications again.

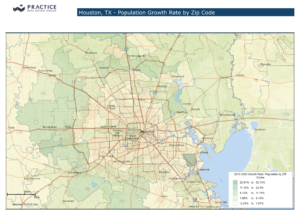

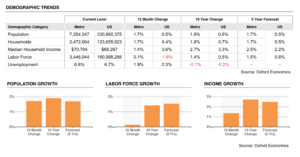

And all the while, “the suburbs are continuing to grow,” George explains. If you were to listen to my calls with clients, you would hear me talk about 99/ Grand Parkway a lot. There is a ton of growth going on all along the Grand Parkway both in terms of new commercial construction and residential construction.There are a lot of rooftops going up -meaning there are a lot of homes/people coming in. The darkest green areas on the population growth map follow the Grand Parkway.”

Population Growth Rate Chart via Practice Real Estate Internal Demographics Team.

Notice that the highest growth rates follow the Grand Parkway.

Houston Is Attractive For Business

As seen in this snapshot from a CNBC special on Texas’ growth, Houston is benefitting from companies transitioning from the coasts.

Benefit From Houston’s Resilience

As Houston shifts away from being solely an oil and gas city, it is investing in the medical community and the opening opportunities for tech. Along with low taxes, a warm climate, and affordability, Houston will bounce back from the pandemic and more than bounce back, it will grow new industries.

First up is Hewlett Packard Enterprises; the tech giant will move from Silicon Valley to the Bayou City, where it is currently building a brand new campus.

“After the pandemic, I’m seeing clients wanting to buy,” Peter said about his clients are responding to the bounce back. “Doctors are looking for certainty and control over their practices. If a pandemic similar to Covid-19 happens again and they are required to close, there are multiple benefits to owning the property you are working out of and great ways to minimize losses you otherwise couldn’t. Where possible, my clients are looking for a good location close to medical centers and retail developments, but with the independence provided with ownership.”

Takeaway: Practitioners are looking forcertainty in real estate to help re establish their practices.

Wondering About Retail Comps?

The most frequently requested data includes comps and demographics. Here’s an overview of each.

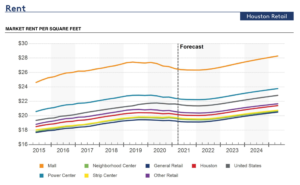

Retail Rent chart via CoStar.

George shared his perspective from last year and where the retail trends are moving now. Here’s what’s happening behind the rents.

“I am noticing a bit more vacancy in the more desirable retail centers (big box store/grocery anchored due to smaller mom and pop restaurants/retailers closing. I have seen several projects that were proposed last year get pushed to this year or were terminated – not a ton, just more than “normal”. This was due to a combination of banks putting a hold on lending as well as not getting enough tenants pre leased to kick off the project. But as a whole, Houston wasn’t hit as hard, and projects that were paused are getting going again.”

More Than Growth, Resilience

While this is growth is mostly in the suburbs, there is some growth in the urban core. See an overview of Houston’s growth in the graphs from CoStar below.

Peter Hays talked about the nuances of the growth. “The big retail centers anchored by grocery stores are still great places to look for a location. Though they weren’t as effected by the pandemic, they still took a hit from restaurants closing and landlords are eager to make a deal. I’m encouraging clients to look at those spaces in suburbs like Lake Jackson, Galveston, Cypress, and The Woodlands. But there are also opportunities in developed and redeveloping areas like The Heights.”

It’s A Good Time To Invest In Real Estate

At Practice Real Estate Group, we value focused expertise. We focus on one small segment of the real estate industry – healthcare real estate – and have nearly a century of healthcare real estate experience under our roof.

We use our experience to come up with creative and effective solutions to hard problems.

If you’re thinking about opening, expanding, or selling a practice, contact us.

Call us at (512) 761-7101 or send us an email at [email protected] to explore your healthcare real estate needs.

Regardless of where you are on your entrepreneurial journey, we offer services to help clients acquire new patients and build healthy businesses.

- Customer Traffic Analysis with Placer.ai

- Retail site comparison and trade area mapping

- Lists of referral sources within your trade area

- Demographic and competition studies

- Lease Renegotiation

- Site Searches

- Condo and Site Purchasing

- Custom Development

- Off Market Acquisition Sourcing