Silver Lining

With employees still working from home this quarter, traditional office buildings have copious amounts of vacant space. Many businesses used the pandemic to press pause on leasing decisions. This has offered a silver lining to medical office tenants, which are stable businesses and provide essential services. Doctors are in an excellent position to renegotiate their office leases.

Dylan Macon, VP of North and West Texas markets, explains the nuance and the silver lining of increased office availability. The opportunity we are seeing is lots of second generation office space. A lot of physicians that were nearing retirement during the pandemic, decided to close shop. That left a lot of great space that’s ready for medical use on the market. Combined with the overall availability, Dallas is in a prime position for growth.”

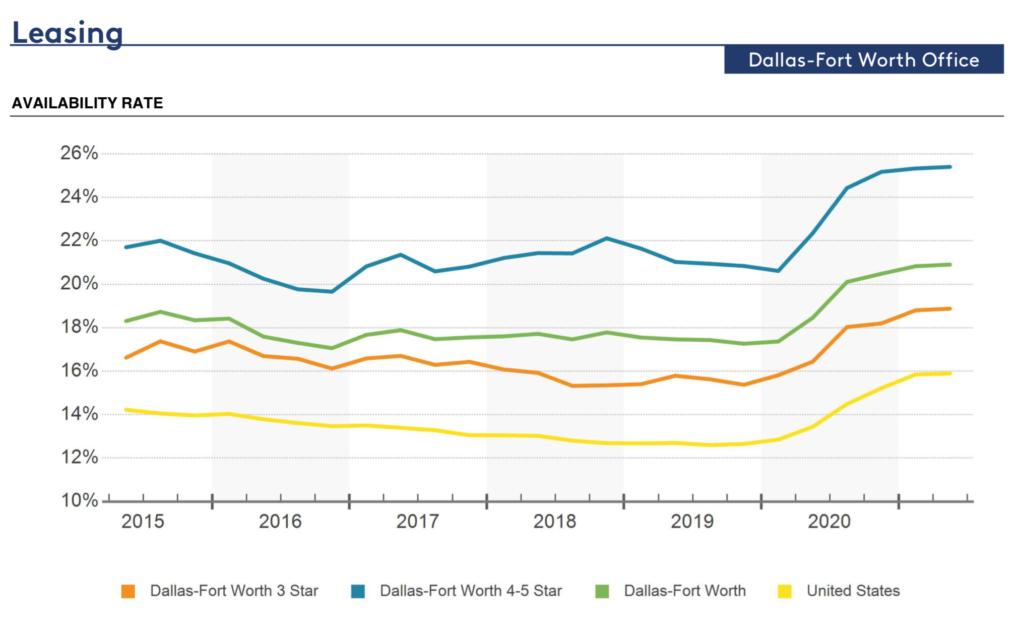

There’s a lot of office available. Corporate relocations and expansions continue to drive demand but as seen in the graph from CoStar, the Coronavirus pandemic did impact office space. For the first time in a decade, DFW experienced 4 consecutive quarters of negative net absorption, but in general, the suburbs are performing well.

Dylan Macon – Agent VP, North Texas and West Texas Markets

How To Navigate Growth

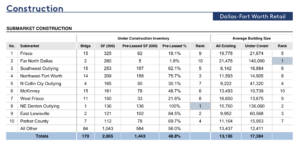

Developers continue to build in DFW, with 3.8 million SF delivered in the past 12 months, and 3.0 million SF currently under construction. DFW is adding supply at one of the fastest rates in the country. But for context, the new construction accounts for less than 1% of inventory, a sign that retail developers continue to be conservative and conscious not to over-extend,There’s also a significant amount of renovation and re-imagination happening in retail. If a developer sees a retail space as underperforming, right now the trend is to turn that space into a fresh, mix used concept than raze it and build something completely new.

Construction chart source: CoStar

Jason Guay, agent for National Accounts, shares what he’s seeing in the big picture. “Recent reports have Austin and Dallas 2nd among US metros for investment prospects. The new construction is no surprise – Dallas has been in the top 2 the last 3-4 years. Between job growth, populations growth, and an overall friendly climate, developers will continue to make space in DFW.”

Jason Guay

Agent, Texas and

National Accounts

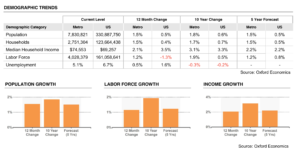

Population Growth Numbers

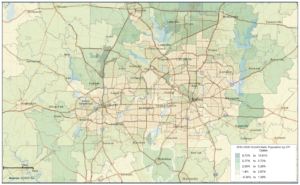

There’s good reason to know the population maps in the Dallas-Fort Worth area. DFW gained more residents than any other metro in the country last year and employment growth is expected to outperform the national benchmark over the next five years. Meanwhile, household incomes continue to rise for North Texans. This positive outlook will mean opportunity for everyone from the start up dentist to the national urology group.

Takeaway: Take advantage of retail openings in the high growth suburbs.

Map Source: PRG Internal Demographics

Relocations and expansions are the name of the game

Today, three of the 10 largest U.S. companies are based in DFW: McKesson, AT&T, and Exxon Mobil. No other region has more than one – New York and Chicago have none. Joining McKesson with Fortune 250 headquarters moves are Charles Schwab and Core-Mark in Westlake, and Jacobs and CBRE in Dallas. DFW hosted 62 moves and expansions over the past 5 years, including Uber, Louis Vuitton, McLaren, Smoothie King, Vistaprint, Salesforce, Peloton, and Pacific Dental.

And the why is not a secret. The Metroplex has new and flexible real estate compared to other cities, and is better able to adapt to the office space or industrial space setups that companies prefer. The infrastructure isn’t dependent on public transit isn’t as dense.

Dylan shares his take: “Now Dallas is the second hottest commercial commercial real estate hub in the country, taking LA’s spot. It’s clear the metroplex is expanding,” he said. “Most of the growth is on the outskirts of town. People are moving to the city, but there’s not much supply because people aren’t leaving. Even PGA is moving here. It’s a good time to be in Texas. And people are seeing that.“

Huge Companies Keep Coming to Town

As seen in this snapshot from a CNBC special on Texas’ growth, Dallas is benefitting from companies transitioning from the coasts.

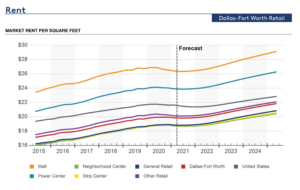

Wondering About Retail Comps?

This graph from CoStar Group shows year over year data on retail rents in Dallas and how they compare nationally.

Rent growth dipped slightly last year but since the onset of the pandemic. (Prior, the metro averaged better than 3% rent growth annually over the past five years, consistently outperforming the U.S. norm.). The highest rents in the region are correlated with more affluent areas in the metroplex with strong buying power. Areas such as North Dallas, Uptown, Frisco, and Southlake feature average rental rates from $35/SF-$50/SF, well above the market average.

More Than Growth, Resilience

Over time, Dallas-Fort Worth’s economic fabric has become more diversified with a global reach that closely resembles the broader U.S. economy. Abundant job opportunities have spurred significant population growth, adding 118,100 new residents in 2020. DFW gained more residents than any other metro in the country. It was behind more than one-third of Texas’ population growth during that period. Employment growth is expected to outperform the national benchmark over the next five years. Meanwhile, household incomes continue to rise for North Texans. The chart above from CoStar offers an aerial view of that growth.

“DFW is active,” Jason says. ” We’re seeing development and investment across all types of asset classes. People continue to want to live and work here. There’s tremendous opportunity for our clients in the healthcare category looking to establish or grow here in DFW.“

It’s A Good Time To Be in Texas

At Practice Real Estate Group, we value focused expertise. We focus on one small segment of the real estate industry – healthcare real estate – and have nearly a century of healthcare real estate experience under our roof.

We use our experience to come up with creative and effective solutions to hard problems.

If you’re thinking about opening, expanding, or selling a practice, contact us.

Call us at (512) 761-7101 or send us an email at [email protected] to explore your healthcare real estate needs.

Regardless of where you are on your entrepreneurial journey, we offer services to help clients acquire new patients and build healthy businesses.

- Customer Traffic Analysis with Placer.ai

- Retail site comparison and trade area mapping

- Lists of referral sources within your trade area

- Demographic and competition studies

- Lease Renegotiation

- Site Searches

- Condo and Site Purchasing

- Custom Development

- Off Market Acquisition Sourcing