There’s No Perfect Deal, But…

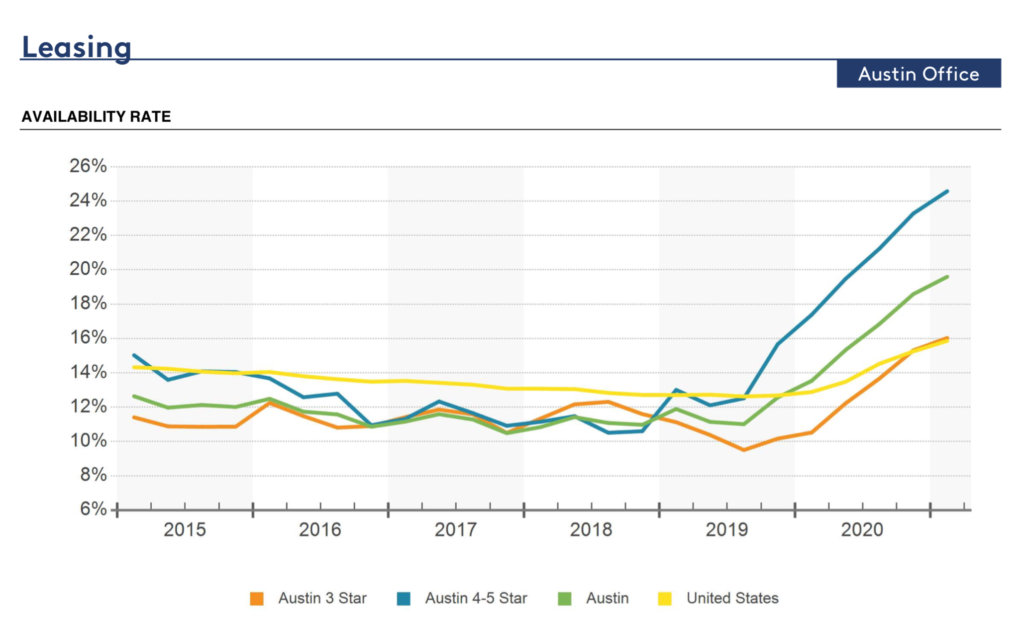

With employees still working from home this quarter, traditional office buildings have copious amounts of vacant space. Small offices are now zooming instead of commuting and/or are downsizing as their spaces come up from renewal.

Medical office tenants, though, are stable businesses, provide essential services, and are in an excellent position to renegotiate their leases.

Macie Morris, Associate Agent for Austin and Central Texas summarized what she’s seeing: “In an office building, where attorneys were before the pandemic, medical tenants now have the power to get a better deal – whether it’s initial P&I money or a different space. Medical tenants located in traditional office buildings that have higher vacancy rates before the pandemic are in a better position than in the past to renegotiate on renewals.”

However, in retail locations, rents have held steady, mostly due to the strength of the Austin market.

Takeaway: Retail is booming, and rents will be going up. Less so in the office.

Renewal Stats. A line graph from Co-Star displays the availability rates climbing in office buildings. Combined with asking rents dropping for the first time since 2011, doctors and dentists are in a prime position to renegotiate their leases.

Macie Morris – Associate Agent, Austin, and Central Texas

Macie Morris – Associate Agent, Austin, and Central Texas

How To Navigate Rising Rents

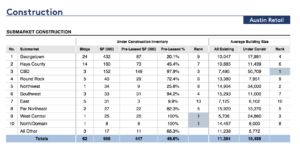

Austin is an anomaly. The Coronavirus pandemic has stalled retail growth elsewhere, but Austin’s population and income growth are some of the strongest in the nation. As such, construction is underway in Central Texas, particularly in the surrounding areas. As a result, rents are staying strong but there is room to get in on the growth – above are the places to look.

“Rents are increasing – In one instance, we’re under contract on an office condo, and the day after we close, the landlord is raising asking prices. There is typically more space in suburban markets of the Austin MSA because of new construction… and often medical tenants are some of the first to sign in a new development,” Macie shared.

Takeaway: Look for new retail locations in Austin’s surrounding areas and suburbs.

Take note that in this CoStar chart, CBD (Downtown), West Central Austin, and North/ Domain Area have the highest Pre-Leased Rates & are at or near capacity.

Take note that in this CoStar chart, CBD (Downtown), West Central Austin, and North/ Domain Area have the highest Pre-Leased Rates & are at or near capacity.

If you’re still looking central

With the pandemic closing some small businesses, there are vacancies in existing retail locations. Even large, national chains are consolidating their presence within regions. These factors make expanding your clinic into a high-traffic area possible.

Macie Morris offers her take: “Covid has provided accessibility for expansion in a retail space. While some retailers have closed, landlords are interested in filling those spaces, which provides an opportunity —definitely for retailers — but for medical tenants in retail as well. With medical clinics, landlords could be more inclined to sign a lease because the office will be more active and are essential.”

Takeaway: National chains are closing storefronts, leaving space to relocate a medical office. We’re seeing less expansions in office because renegotiation power is so strong.

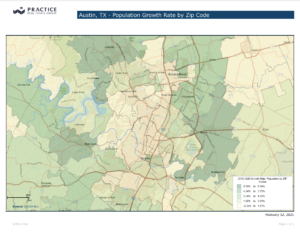

Highest Growth Rates: Leander, Manor, Beecave. Notice that the highest growth rates don’t necessarily align with the tightest market.

Map Source: PRG Internal Demographics

Benefit From Austin’s Growth Right Now

According to the Urban Land Institute the best places to buy commercial real estate in 2021, are:

Raleigh / Durham, North Carolina,

Austin, Texas, and

Nashville, Tennessee.

“Regarding Austin, the market is extremely healthy, especially due to all the large corporations making their moves to this area. We have not seen rents drop, nor nearly as many tenants close shop due to the pandemic and downturn. Between the recession in 2008 and the pandemic in 2020, I’ve rarely seen growth like this. If you couple that economic outlook with the low-interest rates banks are offering, it’s hard to think of a better time to build equity in real estate,” recommends Mark Storey, Senior Vice President and Agent in Central Texas.

Takeaway: If building equity interests you, now is the time to invest in Austin.

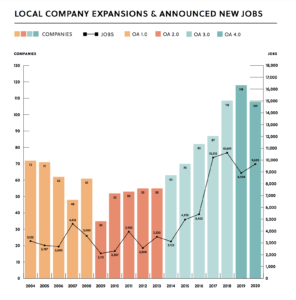

Data Points. As seen in this graph published by the Austin Chamber of Commerce, even after businesses weathered 2020, the Austin job market is growing. Bolstered by a distinct culture and no income tax, Austin is attracting companies and millennials alike, all of whom will need routine and specialized health care.

Mark Storey, SVP and Agent for Austin and Central Texas

Mark Storey, SVP and Agent for Austin and Central Texas

How Does Your Rate Compare?

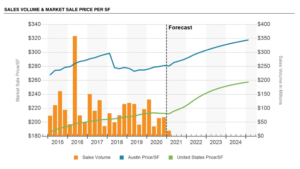

This graph from CoStar Group shows year-over-year data on rents and how Austin’s retail numbers compare nationally. As Mark noted, the economy didn’t contract nearly as much as other metro areas in the U.S. and the price per square foot in retail is projected to increase by at least $100 in the next few years.

More Than Growth, Resilience

“People feel great about the future of Austin,” Macie said. “Job growth, city culture, and good schools make it a place people want to be.”

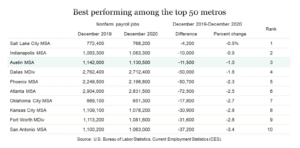

Job statistics prove the point – Austin was No. 3 in the nation for job creation. The U.S. Bureau of Labor Statistics cited that the positive growth in each of the last eight months has brought back 121,200 of Austin’s jobs lost in the pandemic.

It’s A Good Time To Be Confident.

At Practice Real Estate Group, we value focused expertise. We focus on one small segment of the real estate industry – healthcare real estate – and have nearly a century of healthcare real estate experience under our roof.

We use our experience to come up with creative and effective solutions to hard problems.

If you’re thinking about opening, expanding, or selling a practice, contact us.

Call us at (512) 761-7101 or send us an email at [email protected] to explore your healthcare real estate needs.

Regardless of where you are on your entrepreneurial journey, we offer services to help clients acquire new patients and build healthy businesses.

- Customer Traffic Analysis with Placer.ai

- Retail site comparison and trade area mapping

- Lists of referral sources within your trade area

- Demographic and competition studies

- Lease Renegotiation

- Site Searches

- Condo and Site Purchasing

- Custom Development

- Off Market Acquisition Sourcing